The UAE has committed to buying $450 million of carbon credits from the Africa Carbon Markets Initiative (ACMI), to boost Africa's carbon credit production 19-fold by 2030.

Launched during COP27, the ACMI aims to create, amplify, and sustain the next generation of high integrity carbon credits with the ambition to reduce emissions and bring transparency and integrity to voluntary carbon markets in the region.

"As we navigate the climate crisis, carbon markets stand as a pivotal tool in our decarbonisation journey," explained Her Highness Sheikha Shamma bint Sultan bin Khalifa Al Nahyan, President and CEO of the UAE Independent Climate Change Accelerators (UICCA).

"Our collaboration with the Africa Carbon Markets Initiative provides carbon market buyers in the UAE and wider region with access to high-quality carbon credits in Africa. This does not only help to unlock Africa’s carbon credit generation potential, but also supports sustainable investment opportunities and long-term climate impact."

The ACMI is a collaborative effort incubated by Sustainable Energy for All (SEforALL), the Global Energy Alliance for People and Planet (GEAPP), and The Rockefeller Foundation, and rolled out in partnership with the United Nations Economic Commission for Africa (UNECA) and the UN Climate Change High-Level Champions.

Signatories under ACMI’s Advance Market Signal represent the carbon market buyers and investors interested in purchasing African carbon credits to support the development of African carbon markets.

To date, the current signatories under ACMI’s Advance Market Signal include Standard Chartered, Vertree, ETG and Nando’s, with an estimated $200 million collected for purchase of African carbon credits by 2030.

UAE announces first day of Eid Al Fitr

UAE announces first day of Eid Al Fitr

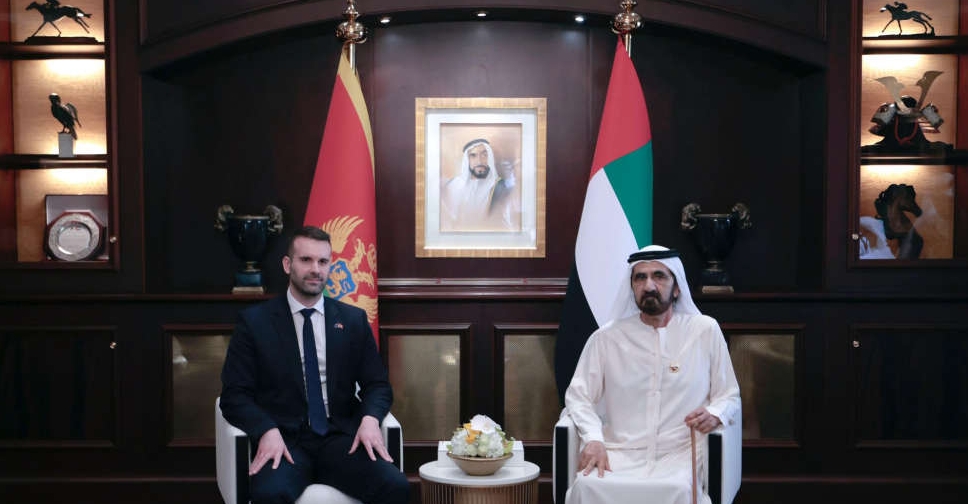

H.H. Sheikh Mohammed 'builds bridges of friendship' with Montenegro's Spajić

H.H. Sheikh Mohammed 'builds bridges of friendship' with Montenegro's Spajić

Heftier fines, jail term for traffic violators under new UAE law

Heftier fines, jail term for traffic violators under new UAE law

Early Eid celebration for Gazan children at UAE Floating Hospital

Early Eid celebration for Gazan children at UAE Floating Hospital