Sales at retailers’ brick-and-mortar locations suffered during the weekend after Thanksgiving as more shoppers skipped the malls and bought online. About $1.73 billion was spent online on Thanksgiving Day, a 25% increase from last year, according to Adobe Systems Inc. On Black Friday, about $822 million was spent by 11 a.m., 15% more than in 2014, the company said. Brick-and-mortar sales fell from last year to $12.1 billion during the two days, according to retail analytics company ShopperTrak, which didn’t provide specific figures for 2014. Retail observers say many of those online purchases are coming at the expense of trips to physical stores, costing merchants more in shipping and depriving them of the impulse sales they often make to shoppers wandering their aisles. Smaller-than-expected crowds turned out at shopping centers in North Carolina, where Jeff Simpson, a director at Deloitte Consulting LLP’s retail practice, was monitoring the action on Black Friday. “Across the board, much less traffic than was anticipated,” Simpson said, without giving specific figures. “Much, much slower.” Traffic Forecast About 135.8 million Americans are expected to shop in stores or online over the four-day weekend, according to the National Retail Federation, the largest U.S. retail trade group. While the forecast represents a 1.6% increase from last year, the NRF’s projection has been overly optimistic in the past. Last year, its pre-Thanksgiving estimate was 4.8% higher than the actual turnout it found in its post-weekend shopping survey. Simeon Siegel, an analyst at Nomura, said he saw decent crowds at the Westfield Garden State Plaza mall in Paramus, New Jersey, but still expected many of the shoppers to already have made purchases online. “This day is going to be a disappointing day,” Siegel said. “If you have the right products you can win, but it’s a tougher environment.” U.S. online sales for Black Friday rose 21.5% from a year ago, with smartphones accounting for 44.7% of all online traffic, IBM Commerce said in an e-mailed statement on Saturday. Smartphone shoppers spent an average of $121.06 per order, up 4.3% from a year ago. Online Shift With the continued shift to spending online in mind, retailers like Wal-Mart Stores Inc. and Target Corp. are putting more of their deals on their websites, or offering them over a longer period of time. Target has countered the increasing popularity of Amazon.com Inc. by providing free shipping and returns on holiday orders, while Wal-Mart plans to offer more than four times as many discounts as last year on the Monday following the Thanksgiving weekend, often dubbed “Cyber Monday.” Amazon’s Black Friday sales rose 20.8% from a year ago, the e-commerce tracker ChannelAdvisor said in a blog post on Saturday, slightly outpacing the 20.3% increase in overall comps for the day. “Thanksgiving definitely was the fastest growing day of the Cyber Five thus far and indicates that consumers moved up their online shopping (and buying) this year,” ChannelAdvisor said. But the weekend after Thanksgiving is still one of the busiest for U.S. retailers, who use the period to highlight their offerings. Target and Wal-Mart say they were expecting record turnouts. “This is the big event,” said Cindy Hudson, Target’s senior vice president of store operations. “We have a large team dedicated all year to helping pull off Black Friday.” Command Centre As stores opened across the country starting Thanksgiving evening, a command center at Target’s Minneapolis headquarters received live video feeds from all of its 1,800 locations. There were also four regional command centers monitoring specific activity in their markets. Inside the command center, workers glued to computer monitors and wall-mounted screens could view the lines outside stores to make sure they were orderly, that shoppers seemed happy and that customers were streaming into the stores at the right pace - not too fast, not too slow. Inside the stores, live feeds at checkout lines monitored for interruptions. Target said Friday in a statement that it had a “strong turnout” on Thanksgiving, without providing specifics. Gaming consoles, televisions and movies were among the top-selling items. The company also said it sold an Apple Inc. iPad every second throughout the day, on average. Still, Deloitte’s Simpson saw less of a sense of urgency among consumers seeking deals. He scoped out pre-Black Friday opening crowds at three major retailers that he wouldn’t identify, and said the lines had six to eight people, far less than in previous years. “It’s early,” he said, “but it doesn’t look great.” (By Lindsey Rupp/Bloomberg)

Dubai to host inaugural Global Government Cloud Forum

Dubai to host inaugural Global Government Cloud Forum

Honda, Nissan aim to merge by 2026 in historic pivot

Honda, Nissan aim to merge by 2026 in historic pivot

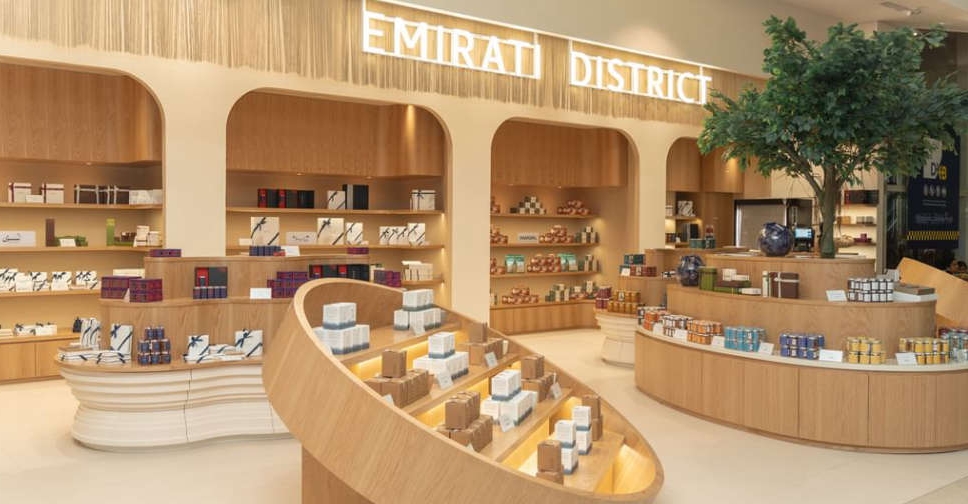

New hub for Emirati businesses launches at DXB

New hub for Emirati businesses launches at DXB

ADNOC drilling expands fleet with new jack-up rigs

ADNOC drilling expands fleet with new jack-up rigs