The Federal Tax Authority (FTA) has announced the postponement of the deadline to file a Tax Return and settle Corporate Tax Payable to December 31, applicable to short Tax Periods ending on or before February 29, 2024.

The FTA’s Decision states that the due date for filing the Corporate Tax Return for Taxable Persons with a short Tax Period that ends on or before February 2024 (e.g. those ending on December 31, 2023, January 31 2024 or February 29, 2024) is postponed to December 31 2024, and the Corporate Tax Payable for these Tax Periods may now also be settled with the FTA by December 31 2024.

The Decision is aimed at Taxable Persons incorporated, established or recognised on or after June 1 2023 that have a financial year ending on or before February 29 2024, which resulted in a first Tax Period that is shorter than the standard 12-month duration.

For example, if a company was incorporated on June 10 2023 and had a financial year from January 1 to December 31, its first Tax Period would be from June 10 2023 to December 31 2023.

Prior to the issuance of FTA Decision No. 7 of 2024, it would have had to submit its Tax Return and settle the Corporate Tax Payable by September 30 2024, in accordance with the provisions of the Corporate Tax Law. However, based on FTA Decision No. 7 of 2024, the deadline to file their Tax Return and settle the Corporate Tax Payable is now December 31 2024.

Dubai to host inaugural Global Government Cloud Forum

Dubai to host inaugural Global Government Cloud Forum

Honda, Nissan aim to merge by 2026 in historic pivot

Honda, Nissan aim to merge by 2026 in historic pivot

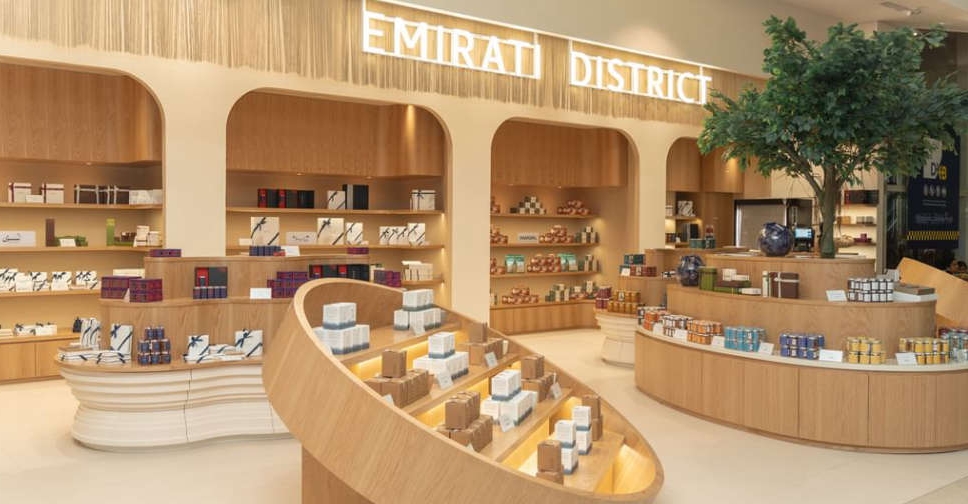

New hub for Emirati businesses launches at DXB

New hub for Emirati businesses launches at DXB

ADNOC drilling expands fleet with new jack-up rigs

ADNOC drilling expands fleet with new jack-up rigs